You are here

Entry Order Type - Market, Stop, Limit

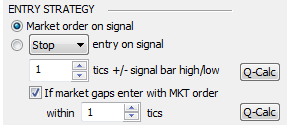

Market Order On Signal: The Autopilot will execute an 'at the market' entry order immediately upon receiving a buy or sell signal from your chosen indicator.

Stop Entry On Signal: Will create a buy stop or sell stop order into the market at the user-defined number of tics/pips above or below the signal price bar close.

For Example: If you have selected stop entry on signal and you have placed a 3 in the tics/pips field, upon receiving a buy signal, Track ‘n Trade will automatically place your buy stop entry order three tics/pips above the close of your signal price bar.

Advantages and disadvantages to using a Stop entry order:

- The advantage of a stop entry order is that the market must move the direction of your bullish/bearish signal before entering a trade. If the market retraces before reaching your stop order, your stop would not be filled, and you would not suffer the loss from entering the trade as you would if using a market order.

- The disadvantage of a stop entry order is that you are sacrificing the X number of pips/tics above or below the entry price bar for the added assurance that the market is moving your direction before entering the trade.

Limit Entry On Signal: Will create a sell limit or buy limit order into the market at the user-defined number of tics/pips above the signal price bar close for a sell limit order or below the close for a buy limit order.

For example: If you have selected a limit entry order on signal and you have placed a 3 in the tics/pips field, upon receiving a buy signal, Track ‘n Trade will automatically place your buy limit entry order three tics/pips below the close of the signal price bar.

Advantages and disadvantages to using a Limit entry order:

- The advantage of using a Limit Entry Order is that if the market pulls back against the prevailing trend that created the entry signal, you could enter the trade at a better fill price.

- The disadvantage to this strategy is that the market may continue moving in the direction of the trend and may never retrace sufficiently to fill your entry order. You can potentially miss the trade altogether.

MIT (Market If Touched) Entry on Signal [Futures Only]:

If market gaps enter with MKT order within X tics/pips: There is a chance that the market may gap over your specified stop/limit entry price. This filter states that if the market gaps beyond your stop/limit entry price within so many tics/pips, then enter instead with a market order. If the market gaps over your entry price beyond your specified allowable tics/pips, the Autopilot will not place the trade.