You are here

Ichimoku Kinko Hyo

Quick Description

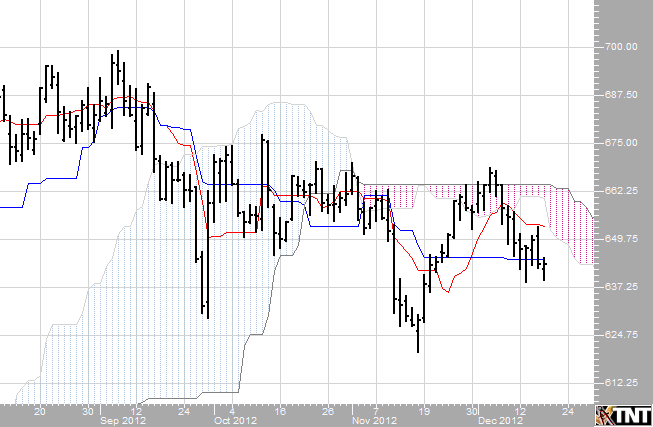

Ichimoku Kinko Hyo is a purpose-built trend trading charting system that has been successfully used in nearly every tradeable market. It is unique in many ways, but its primary strength is its use of multiple data points to give the trader a deeper, more comprehensive view into price action. This deeper view, and the fact that Ichimoku is a very visual system, enables the trader to quickly discern and filter "at a glance" the lowprobability trading setups from those of higher probability.

History

The charting system of Ichimoku Kinko Hyo was developed by a Japanese newspaper man named Goichi Hosoda. He began developing this system before World War II with the help of numerous students that he hired to run through the optimum formulas and scenarios - analogous to how we would use computer simulated backtesting today to test a trading system. The system itself was finally released to the public in 1968, after more than twenty years of testing, when Mr. Hosoda published his book which included the final version of the system. Ichimoku Kinko Hyo has been used extensively in Asian trading rooms since Hosoda published his book and has been used successfully to trade currencies, commodities, futures, and stocks. Even with such wild popularity in Asia, Ichimoku did not make its appearance in the West until the 1990s and then, due to the utter lack of information in English on how to use it, it was mostly relegated to the category of another "exotic" indicator by the general trading public. Only now, in the early 21st century, are western traders really beginning to understand the power of this charting system.

Equilibrium at a Glance

The name Ichimoku Kinko Hyo, which translates to "Equilibrium chart at a glance" aptly describes the system and how it is to be used, as described below:

• While Ichimoku utilizes five separate lines or components, they are not to be used individually, in isolation, when making trading decisions, but rather used together to form an integrated "whole" picture of price action that can be gleaned "at a glance". Thus, a simple look at an Ichimoku chart should provide the Ichimoku practitioner with a nearly immediate understanding of sentiment, momentum and strength of trend.

• Price action is constantly measured or gauged from the perspective of whether it is in relative equilibrium or disequilibrium. Hosoda strongly believed that the market was a direct reflection of human group dynamics or behavior. He felt that human behavior could be described in terms of a constant cyclical movement both away from and back towards equilibrium in their lives and interactions. Each of the five components that make up Ichimoku provide its own reflection of this equilibrium or balance.

Example

Preferences

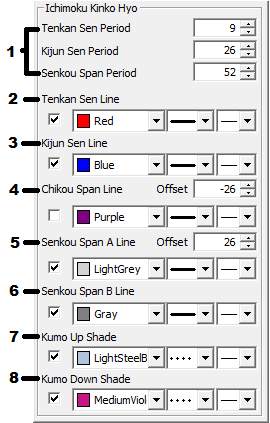

Right-click anywhere on the chart and go to "Overlay Properties." Select Bollinger Bands from the list. The preferences will appear in the Control Panel. (Once you click on the chart, the Preference tab will go back to chart settings.)

Restore Settings: TNT Default will change your settings back to the original software settings. My Default will change current settings to your personalized default settings. Apply To All Charts will apply your selected settings on all open charts. Save As My Default will save your current personal settings.

1. Periods: These are the periods defined for the Tenkan Sen Line, the Kijun Sen Line, and the Senkou Span Line. These are the period over which an average of the high and low are calculated.

2. Tenkan Sen Line (Conversion Line): With the default Period this is simply (9-period high + 9-period low)/2. In a daily chart it is an average of the 9-day high and 9-day low.

3. Kijun Sen Line (Base Line): This is the same as the Tenkan Sen Line but with a 26 day period (using a daily chart and default values).

4. Chikou Span Line (Lagging Span): This is a graph of the closing price plotted at the Offset specified. On a daily chart using the default it would draw the current close 26 days back.

5. Senkou Span A Line (Leading Span A): This is the midpoint between the Tenkan Sen Line and the Kijun Sen Line plotted at the Offset specified. With the default it would be plotted 26 days ahead.

6. Senkou Span B Line (Leading Span B): This is also like the Tenkan Sen Line but with a 52 day period (using a daily chart and default values).

7. Kumo (Cloud) Up Shade: This is the area between the Senkou Span Lines when the Senkou Span A Line is above the Senkou Span B Line. The Trend is up when prices are above the Kumo Shading area and strengthened when the Kumo Shading is an Up Shade.

8. Kumo (Cloud) Down Shade: This is the area between the Senkou Span Lines when the Senkou Span B Line is above the Senkou Span A Line. The Trend is down when prices are below the Kumo Shading area and strengthened when the Kumo Shading is a Down Shade.