You are here

Candlestick Reversal Patterns

Just as many traders look to bar charts for double tops and bottoms, Head & Shoulders, and technical indicators for reversal signals, candlestick formations can also be looked upon for the same purpose. A reversal does not always mean that the current uptrend/downtrend will reverse direction, but merely that the current direction may end. The market may then decide to drift sideways. Candlestick reversal patterns must be viewed, within the context of prior activity, to be effective. In fact, identical candlesticks may have different meanings depending on where they occur within the context of prior trends and formations.

Hammer -- a candlestick with a long lower shadow and small real body. The shadow should be at least twice the length of the real body, and there should be no or very little upper shadow. The body may be either black or white, but the key is that this candlestick must occur within the context of a downtrend to be considered a hammer. The market may be "hammering" out a bottom.

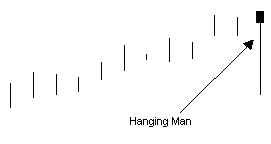

Hanging Man -- identical in appearance to the hammer, but appears within the context of an uptrend.

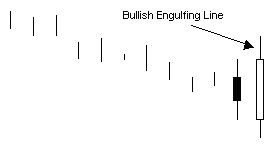

Engulfing Patterns -- Bullish -- when a white, real body totally covers (engulfs) the prior day's real body. The market should be in a definable trend, not chopping around sideways. The shadows of the prior candlestick do not need to be engulfed.

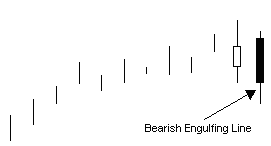

Bearish -- when a black, real body totally covers, "engulfs" the prior day's real body. The market should be in a definable trend, not chopping around sideways. The shadows of the prior candlestick do not need to be engulfed.

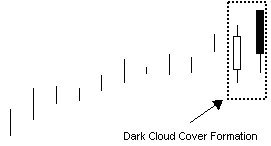

Dark-Cloud Cover (bearish) -- a top reversal formation where the first day of the pattern consists of a strong white, real body. The second day's price opens above the top of the upper shadow of the prior candlestick, but the close is at or near the low of the day, and well into the prior white, real body.

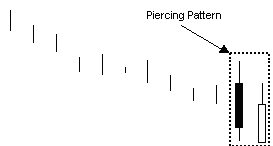

Piercing Pattern (bullish) -- opposite of the dark-cloud cover. Occurs within a downtrend. The first candlestick having a black real body, and the second has a long, white real body. The white day opens sharply lower, under the low of the prior black day. Then, prices close above the 50% point of the prior day's black real body.

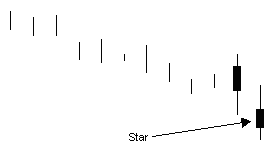

Stars -- These candlestick formations consist of a small real body that gaps away from the real body preceding it. The real body of the star should not overlap the prior real body. The color of the star is not too important, and they can occur at either tops or bottoms. Stars are the equivalent of gaps on standard bar charts.

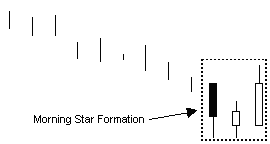

Morning Star -- a bullish bottom reversal pattern. The formation is comprised of 3 candlesticks. The first candlestick is a tall black real body followed by the second, a small real body, which gaps (opens) lower (a star pattern). The third candlestick is a white real body that moves well into the first period's black real body. This is similar to an island pattern on standard bar charts.

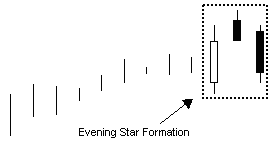

Evening Star -- a bearish top reversal pattern and counterpart to the Morning Star. Three candlesticks compose the evening star, the first being long and white. The second forms a star, followed by the third, which has a black real body that moves sharply into the first white candlestick.

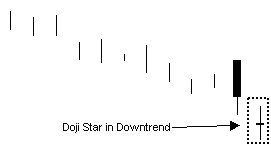

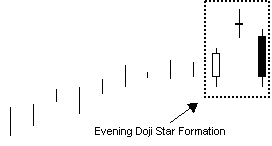

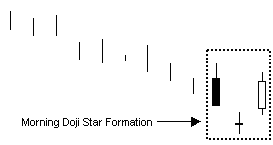

Doji Stars -- When a doji gaps above a real body in an uptrend, or gaps under a real body in a falling market, that particular doji is called a doji star. Two popular doji stars are the evening star and the morning star.

Evening Doji Star -- a doji star in an uptrend followed by a long, black real body that closed well into the prior white real body. If the candlestick after the doji star is white and gapped higher, the bearishness of the doji is invalidated.

Morning Doji Star -- a doji star in a downtrend followed by a long, white real body that closes well into the prior black real body. If the candlestick after the doji star is black and gapped lower, the bullishness of the doji is invalidated.

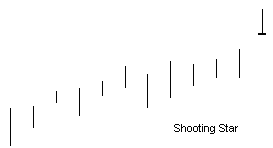

Shooting Star -- a small real body near the lower end of the trading range, with a long upper shadow. The color of the body is not critical. Not usually considered a major reversal sign, only a warning.