You are here

Andrews Pitchfork Theory

Dr. Alan Andrews developed a channel technique to show areas of support and resistance from a baseline. This use of a median line is the key to using the Andrews Pitchfork. Buying near lows and selling near highs that are identified by the "tines" of the pitchfork. The basic premise is to trade the channel from one level of support or resistance to the next.

Interpretation

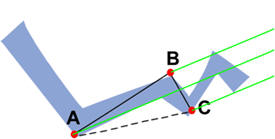

The first element to draw the Andrews Pitchfork is the centerline. The middle tine, or median line, begins at the most recent contract low or high. To plot the direction of this point we must attain the other two points. The top tine is determined by looking at the highest move made from the origin of the contract low or high. The next point is found by looking at the retracement of that move. For example, a contract begins at point A, rallies to point B, and sells off from point B to point C. A line is drawn from point B to point C, and the line originating at point A splits those two lines equally.

This pitchfork shows continuing points of support and resistance. The general use of this tool is to sell when the market rises to line B, take profits once prices reach line A, and buy when prices dip to line C. This series of movements within the pitchfork affords traders the opportunity to trade a channel system within a trending market.

This pitchfork shows continuing points of support and resistance. The general use of this tool is to sell when the market rises to line B, take profits once prices reach line A, and buy when prices dip to line C. This series of movements within the pitchfork affords traders the opportunity to trade a channel system within a trending market.