You are here

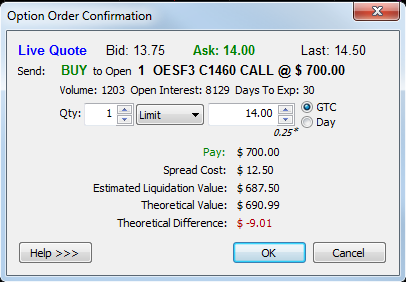

Options Order Confirmation

Quickest Fill

To achieve the quickest possible fill:

- Buy a contract (i.e., bid for a contract) at the ask.

- Sell a contract (i.e., ask someone to buy a contract from you) at the bid.

Remember for quickest fill:

- When buying: your bid = market ask

- When selling: your ask = market bid

Best Price

To get the best possible price (as opposed to the quickest fill), enter at a different price than:

- If selling, the bid: to sell a contract, place an ask that is higher than the bid.

- If buying, the ask: to buy a contract, place a bid that is lower than the ask.

Remember for best price:

- When Buying: your bid < market ask

- When Selling: your ask > market bid

Days to Exp

Days left until the expiration of the option. The contract expires at the end of the 0th day until expiration.

Qty

The number of options contracts one is seeking to buy or sell.

Market Price

The current value of the option at a particular strike price.

Limit/Premium Value

When placing an options order, this is a modifiable value. This value changes according to its minimum move.

Note:

A limit/premium value further away from the current bid/ask/last is less likely to be touched in the short term.

GTC

An order that is Good 'Til Cancelled (GTC) will remain in the market until it is:

- canceled by the client

- executed in the market

- canceled because it has expired

Day

A Day option order is canceled at the current trading session’s market close if it has not yet been executed in the market.

Premium Minimum Move

The limit/premium of an option can change by certain increments. The amount of this increment is the premium minimum move.

Cost

If the option is on the buy side, then it will cost you money to acquire it.

Collect

If the option is on the sell side, then you will collect an amount of money if it is acquired.

Spread

The difference between the bid and the ask is called the spread.

Liquidate Value

The current value. Closing the option at the current value yields the liquidate value.

Premium

The price of the option.

Total Premium

Premium * quantity * 1 full point value of the underlying futures contract.

Theoretical Value

The calculated value of the option based on an options pricing model.

Volume

The number of transactions that have occurred for the given option symbol today.

Open Interest

The total number of options that are not closed or executed.

Option Symbol

OAUDV2 C100 is an example of an options symbol:

- OAUD is the symbol base, where AUD is the underlying symbol.

- V2 is the symbol for the month and year.

- C100 is the strike quote, a call at 100.