- Getting Started

- Control Panel

- Toolbars

- Chart Overlay Indicators

- Indicator Windows

- COT - Commitment of Traders

- PROB - Market Probability

- RBN - Ribbon

- SEAS - Seasonal Trend

- AD - Williams Accum/Dist "Williams Accumulation/Distribution"

- ATR - Average True Range

- %B - Percent Bollinger Bands

- BW - Bollinger Bandwidth

- CCI - Commodity Channel Index

- CMF - Chaikin Money Flow

- DMI - Directional Movement Index

- FSTO - Fast Stochastics

- GTR - Gator Oscillator

- HVOL - Historic Volatility

- KST - Know Sure Thing

- MACD - Moving Average Convergence/Divergence

- MFI - Money Flow Index

- MOM - Momentum

- OBV - On Balance Volume

- PPO - % Price Oscillator

- PVO - % Volume Oscillator

- %R - Williams' %R "Williams Percent R"

- ROC - Rate of Change

- RSI - Relative Strength Index

- SRSI - Stochastic Relative Strength Index

- SSTO - Slow Stochastics

- TRIX - Triple Exponential Average

- ULT - Ultimate Oscillator

- VOL - Volume

- Plug-Ins

- End User License Agreement(EULA)

- Gecko Software Risk Disclosure

You are here

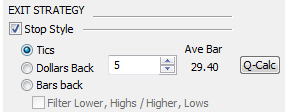

Stop Style

Initial Stop Placement:

The Track 'n Trade Autopilot offers three different Stop order styles: Tics when trading Futures, Pips when trading Forex; Bars Back; and Dollars Back. The same quantity field is used for each of these styles.

If you select Tics/Pips, then enter how many tics or pips you would like Track 'n Trade to place your initial stop order behind the market.

If you choose Dollars Back, enter the dollar amount you want Track ‘n Trade to calculate for the initial placement price of your stop order.

If you choose Bars Back, then enter the number of price bars you want Track 'n Trade to count back, and place your initial stop order. The order will place at the high or the low price of that bar (high if you are in a short position, low if you are in a long position). Notice that you can add extra tics/pips to that high/low price by entering a value to the right of the decimal point (like 3.6 is 3 bars back high/low price plus 6 tics/pips).

Filter Lower, Highs/Higher, Lows: We also have a filter associated with the Bars Back selection. This filter tells Track 'n Trade to only advance an auto-trailing stop if the price bar makes a higher high, on a long position, or a lower low on a short position.

Example: If we are in a long position, and we've chosen to automatically trail the market with a five bar back stop, and the market makes three advancing bars, with higher highs, and then three bars where the highs are not consistently higher than the previous price bar, then Track 'n Trade would hold its position, without advancing the trailing stop.

Upon receiving a sixth price bar, with a higher high, Track ‘n Trade would then advance the auto trailing stop to the lowest tic/pip counting five price bars back.

Jump Stop:

A jump stop is a stop order that has a condition on it, whereas when the condition is met the stop moves to break even or +/- x pips/tics.

The condition: When the profit is (If market moves) >= the specified x pips/tics.

Then, if market moves (Trailing jump stop): This works similar to the jump stop but just repeats. First you must have the first jump stop condition to have been met and then this will be activated to move(trail) the stop X pips/tics when the profit goes an additional Y pips/tics profit.

Trailing Stop:

The first radio button labeled "No Trailing Stop," means that Track 'n Trade will not advance the stop loss order beyond its initial placement price.

The second radio button labeled "Continuous" tells Track 'n Trade to automatically advance the stop loss order based on the entry amount listed in the previous "Stop Style" section.

For example, with each price advance of the market, Track 'n Trade would also advance the trailing stop, maintaining 10 points, or pips back from the highest, or lowest price level achieved. If the market then falls back within 10 points or pips, to say 8 points or pips, then Track 'n Trade would hold the stop at that level until the market begins to advance once again. Of course, if the market retraces a full 10 points or pips, then the stop order would be executed and you would be out of the market.

The Track 'n Trade Autopilot also has the ability to automatically trail the stop loss order based on several indicators which have specifically been designed to help maximize the stop loss order profit potential. Before using these turn on the indicator on the chart. The first is the PSAR, or Parabolic SAR, which stands for Stop & Reverse, the second is the Bulls 'n Bears Blue Light System, and the third is the ATR Stop or Average True Range. All three stop loss order systems work on the same basic principle, other than the fact that the Blue Light System has been mathematically, and hyperbolically linked into the Bulls 'n Bears Red Light, Green Light formulas, and are automatically calculated from within the Bulls 'n Bears system; whereas the PSAR and the ATR stop systems are user definable.

When one of these three auto-trailing stop systems are selected, Track 'n Trade will automatically place the stop-loss order at either the initial price level specified previously, such as 5 price bars back, or on the first price point of the selected system; whichever is closer to the market.

For example, if you specify the initial placement of the stop-loss order to be five price bars back, yet five price bars back is actually closer to the market than the initial point of the PSAR, Track 'n Trade will place the stop order five price bars back, then wait to begin trailing the stop loss order until the PSAR stop price point has surpassed the initial five bar back level. This will be the same behavior for all three mathematically calculated stop systems.

The next selection is "Until Break Even." If selected, Track 'n Trade will automatically trail the stop loss order based on the selection until it reaches the price level of the entry order; upon reaching the same price point as the entry order, Track 'n Trade will stop the automatic trailing of the stop order, and leave it active at the break-even price level.