You are here

Williams Accumulation/Distribution (AD)

Larry Williams created this indicator in an attempt to measure market pressures. It specifically looks for a difference in price and measures it through market sentiment and strength. The key is to look for strong differences between what the market does and what the indicator does. Looking for substantial divergence from the AD index versus the underlying chart is the key to future price direction.

The main thing to look for is a difference between the AD and the market trend. If a market were to make a matching or lower low, or a matching or higher high and the AD fails to follow the market trend, this is divergence. Divergence implies that a reversal in the dominant trend may be near.

A series of lower lows would read as a decreasing AD. The pattern created by the AD and the differences in the chart are what the trader looks for. Divergence, or a difference from the pattern, is what you want to see. For example, if the market continues to march to higher territory and the AD follows by doing the same, then there is no divergence. However, if the market makes several new highs but the AD fails to make new highs, it is a warning signal of a market about to reverse direction.

Calculation

The AD index is computed several different ways. Some computations normalize the index, while others add extra smoothing factors through the use of moving averages.

The first comparison checks for accumulation. (Is the current close higher than the previous close?) If the market is accumulating, subtract the difference between current close and low. Add the difference to the Accumulation/Distribution Index. Traders perceive an undervalued market and they buy.

If Closet > Closet-1 then ADt = ADt-1 + (Closet - Lowt)

The second comparison checks for no change in price. If correct, the AD index does not change.

If Closet = Closet-1 then ADt = ADt-1

The last and final comparison checks for a down market. It looks for the current close below previous close. If it's correct, the market is distributing. The software first computes the difference between current high and close. Then it subtracts that difference from the AD index. This measures market distribution. Traders perceive an overvalued market and are selling.

If Closet

ADt: The accumulation/distribution index for the current period.

ADt-1: The accumulation/distribution index for the previous period.

Closet: The closing price for the current interval.

Closet-1: The closing price for the previous interval.

Hight: The true high price for the current interval (current high or previous close).

Lowt: The true low price for the current interval (current low or previous close).

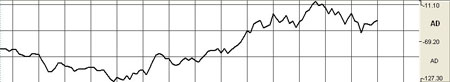

Example of the Williams AD in the Indicator Window

Preferences

Right-click on the AD button in your Indicator toolbar and select AD Settings. The Preferences Tab will open in the Control Panel and the AD preferences will be displayed. (Once you click on the chart, the Preference tab will go back to chart settings.)

Restore Settings: TNT Default will change your settings back to the original software settings. My Default will change current settings to your personalized default settings. Apply To All Charts will apply your selected settings on all open charts. Save As My Default will save your current personal settings.

Line: Choose the color, line style, and line thickness of your line and MA line. You can also choose to show/hide the MA line and use Williams AD.

View up to four Thresholds at values and colors of your choice. Choose when you want Buy/Sell Arrows to show and what color.