You are here

Fibonacci Retracements

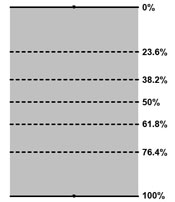

Fibonacci Retracement levels correspond with percentage retracements that occur in the ebb and flow of a market trend. According to the Elliott Wave Theory, market trends tend to occur in five distinct waves. See the Elliott Wave section for more information. Elliott asserted that these counter-trend waves will usually retrace against the trending waves by 38.2, 50, and 61.8 percent. These retracement percentages correspond to natural ratios discovered by the Greeks called the Golden Ratio and rediscovered by Fibonacci, a medieval Italian Mathematician.

Interpretation

Interpretation

Commodity prices will frequently consist of an initial wave, a second wave (often retracing 61.8% of the initial move), a third wave (usually the largest), another retracement, and finally a 5th wave (the last gap), which would exhaust the movement.

In Track ‘n Trade Live, you have three tools that you can use to apply these concepts: Fibonacci Retracement, Fibonacci Time Zones, and Fibonacci Arc.